No matter the economic cycle, we can point to a number of headwinds and challenges, while simultaneously highlighting a few tailwinds and bright spots. This post from your friends at FORECON draws attention to a few of those noteworthy bright spots.

Pictured here, U.S. hardwood grade lumber prices are currently at a level that is slightly above inflation on a long-term relative basis (see the tan line and the red line, below). Additionally, U.S. energy prices are relatively affordable, considering historic price levels.

It’s worth noting that the Fed raised rates 11 times between 2022 and 2023. Through it all, the U.S. has remained at full employment (see the red circle, below), indicating resilience and a certain amount of underlying strength in our domestic economy.

According to the most recent quarterly report by the Bureau of Economic Analysis, U.S. Gross Domestic Product (GDP) is growing at a 2.4% annualized pace, as illustrated by the figure, below. Furthermore, U.S. inflation (CPI for all goods) decreased 0.1%, per the April 10, 2025 Bureau of Labor Statistics monthly report. These current GDP and CPI trends are favorable, considering the elevated interest rates and past inflationary pressures our domestic economy has faced.

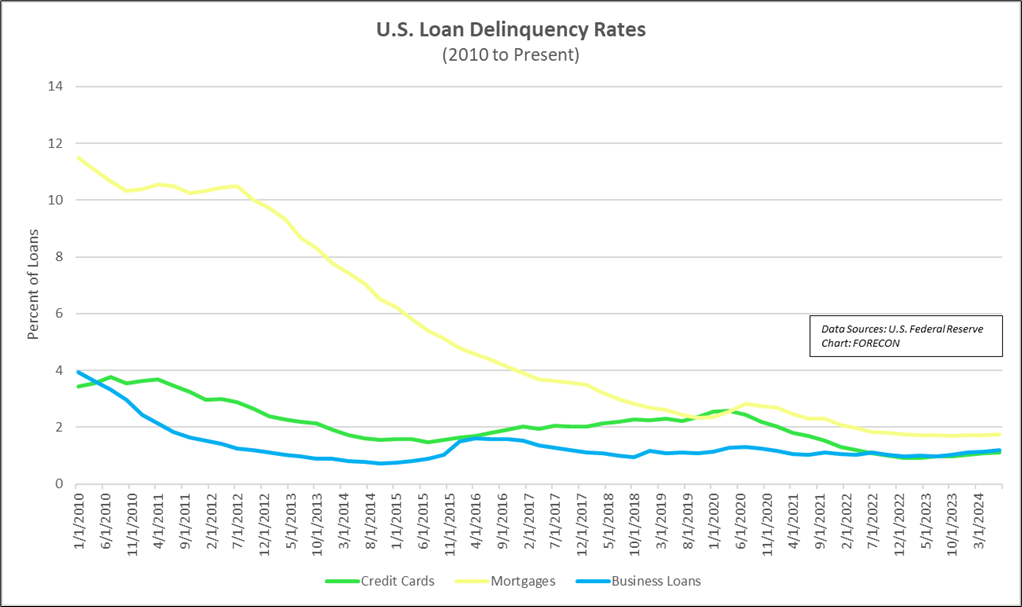

Additionally, loan delinquencies remain low, by historic standards (as shown below). This is a positive sign for our financial sector, and for the U.S. economy as a whole.

Because U.S. hardwood grade lumber prices tend to be more closely correlated with U.S. single-family housing starts than with single-family housing completions, we watch monthly single-family starts and the 12-month moving average closely. Pictured below, single-family starts fell in mid-2024, and have regained some ground. The 12-month moving average plateaued and has continued a fairly steady pace, despite elevated mortgage rates. As long as interest rates remain near current levels, watch for single-family starts and completions to remain near their current levels.

Although U.S. trade policy (tariffs), U.S. debt-to-GDP trends, and global market dynamics certainly pose a number of challenges, both our domestic economy and our regional forest products industry have adapted to headwinds in the past. Additionally, reframing the global economic picture to include some of the bright spots we’ve outlined helps to illustrate some of the fundamental underlying strength and resilience in our domestic economy.

We hope you enjoyed this discussion of recent market trends. And, we encourage you to please contact FORECON’s friendly, knowledgeable staff, if you’d ever like our help with market analysis, acquisition due diligence, or a customized presentation related to market trends and industry outlook. We can help!